Report Summary:

In 2024, FreeMove Alliance had nearly 100% customer renewal with a 23% acquisition rate. It also won a number of significant new deals to reach a record number of managed lines.

What’s New?

- June 2024: FreeMove Alliance held its first FreeMove Summit in Paris (France), exceeding expectations with 150 participants attending from 20 countries.

- June 2024: FreeMove Alliance has won more new deals so far in 2024 than in each year since 2018. These include more than a dozen large deals, helping it to reach a new milestone of 4.4 million lines under management.

- June 2024: FreeMove Alliance continues to connect natcos and partners to its FreeMove Automation Solution (FAS), with digital order management now supported in 13 countries.

- June 2024: FreeMove Alliance launched a new sustainability community, which aims to share best experiences and co-create with customers to find opportunities for better serving them in achieving their sustainability goals.

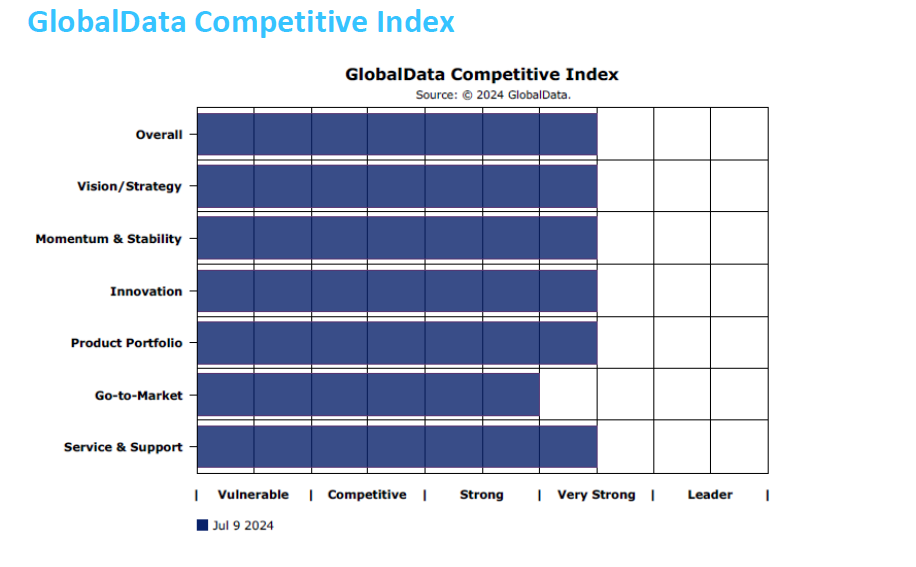

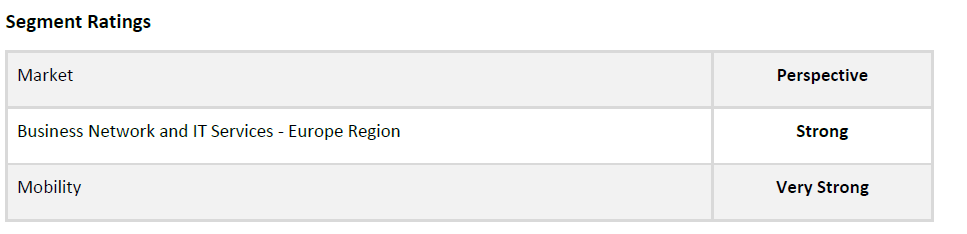

GlobalData Competitive Index

Rating Update Summary

Rating : Very Strong

In 2023, FreeMove Alliance had nearly 100% retention with a 24% acquisition rate. It also made significant progress onboarding member NatCos to its automation hub and advanced its brand strategy, including a new logo.

Perspective – Essential Analysis

Strengths

- Adapted Offer: FreeMove Alliance offers a multi-local mobile connectivity solution with its “glocal” approach. Differentiated central reporting with user-friendly interfaces and cost optimization covers multiple operators and countries, and FAS allows multinational corporations (MNCs) to digitize the management of their mobile fleets with single, direct, secure access to one of its leading mobile operators.

- Growing Installed Base: Despite a slightly lower win rate for new deals than the previous year, the number of new deals won by FreeMove Alliance has grown each year since 2019. With a number of significant wins already in 2024, the installed base of managed lines reached 4.4 million in 2024.

- Global Coverage: FreeMove Alliance provides services in over 125 countries across Europe, Asia-Pacific, Africa, and the Americas. FreeMove Alliance members and partners are also at the forefront of the development of 5G technology and are helping businesses in their transformation journeys.

Limitations

- Different Strokes: While connectivity remains the bedrock of the FreeMove Alliance offer, MNCs may take this for granted and look higher up the value stack for differentiation and productivity gains. For this reason, FreeMove Alliance is looking toward services such as a unified approach to 5G campus networks as well as its new FAS solution, which digitizes management of mobile fleets through its automation hub.

- Price Ceiling Drops: The emergence of uncapped voice and data calls may affect FreeMove Alliance members’ ability to increase prices; indeed, most members continue to report flat mobility revenues from enterprises.

- What Next?: FreeMove Alliance is valuable for customers who need to procure and manage mobility centrally and synchronize service delivery, tariff management, and support on an extensive, multi-operator footprint. Expanding its remit is a continuing challenge, however, as members sort out which areas make sense for cooperation, and which remain the domain of individual members. Potential new services, such as a unified approach to mobile private networks, could enhance its proposition, but they are complex to integrate.

Category Ratings and Justification

Vision/Strategy

Rating : Very Strong

- FreeMove Alliance’s plans to expand its target market to mid-size companies (including an ongoing lead generation campaign) and ease complexity by centrally supporting local account managers are sound initiatives to enhance revenues for its members without changing its core value proposition. FreeMove Alliance also saw nearly 100% retention in 2023 and 2024, while acquisition of new customers was 24% in 2023.

- The FAS offering is pivotal to address complexity by connecting all members and partners (including their respective natcos) via APIs to their own IT service management systems (ITSMs) to make the customer experience for mobile management seamless. This solution already connects all members for order management workflow. In the future, FreeMove Alliance will evaluate support for other mobile business workflows globally such as incident management and expense management. All members of the alliance, plus SwissCom, are already connected to FAS. FreeMove Alliance is working to onboard new partners to the platform.

- Increasing brand awareness has been an important goal for FreeMove Alliance. In 2023, FreeMove Alliance introduced a new logo that represents flexibility, strength, synergy, and commitment of its members. An updated PR/marketing content strategy focuses on people, success stories, the alliance, values, and the future; while its 20th anniversary celebration in 2023 stressed the unity, stability, and humanity of the alliance as well as a planned uptick in natco engagement with the generation of FreeMove ambassadors.

Momentum & Stability

Rating : Very Strong

- Despite geopolitical challenges and uncertainty, lingering supply chain issues, and other economic considerations that have delayed deployment projects among some European MNCs, FreeMove Alliance has seen solid retention rates (of nearly 100%) in 2022, 2023, and 2024, reaching above its expected rate for retention.

- FreeMove Alliance is an exclusive partner for many top MNCs, with over 500 MNC target customers. It has a relevant share of the addressable market with 4.4 million mobile connections under management. New initiatives for digitization of global mobility management, including a unified approach to mobile private networks, should heighten its value to new and prospective customers of alliance members. Multi-local companies and those with smaller mobile fleets are also attracted by FreeMove Alliance’s capability to simplify and centralize operations.

- As leaders in their home markets, FreeMove Alliance members will be among the few operators capable of introducing and marketing reliable global 5G networks and potentially hybrid public/private cellular networks. FreeMove Alliance will play a unique role in helping members provide international 5G service to MNCs.

Innovation

Rating : Very Strong

- The FreeMove Alliance proposition allows members to allocate the best-tailored bundle for each group of end users, depending on their needs, across a larger footprint than any could offer alone.

- With FAS, FreeMove Alliance is interconnecting all its members and partners and their respective natcos, allowing MNCs to manage their global mobile fleet while connecting their ITSMs to a single leading mobile operator.

- FreeMove Alliance’s new efforts to court mid-size MNCs and to further simplify processes through FAS, as well as potentially launch desktop-as-a-service (DaaS) and campus 5G network services, are all innovative ways to maintain and improve its momentum.

Product Portfolio

Rating : Very Strong

- FreeMove Alliance offers a portfolio consisting of access services, central report, and service management, facilitating enterprise mobility, mobile access services, telecom expense management, service and delivery management across alliance members and partners under a single master agreement covering more than 125 countries with single-point accountability resting with the lead operator.

- In 2022, FreeMove Alliance introduced FAS following the successful integration of ITSM capabilities into its mobility service. While the majority of member natcos were onboarded onto the platform by end-2023, 2024 will see almost all natcos added to the platform. Capabilities include fleet management through customers’ ITSMs; digitized order management of mobile connectivity and devices; near real-time inventory and order status; and centralized, data-driven decision-making.

- FreeMove Alliance’s global telecom expense management portfolio provides usage visibility via a secure, web-based portal with a clear and up-to-date view of cost and usage for mobile device fleets. It enables businesses to examine usage in detail, including region, business unit, time, and type of connection. Recently, FreeMove Alliance added a new profile for telecom expense management, which provides improved customer experience and cost optimization across 65+ countries covered by the solution.

Go-to-Market

Rating : Strong

- FreeMove Alliance has established a unique governance model and built several programs and working groups designed to bring together the best aspects of the various member company cultures, diversity, and competitive advantages. This “glocal” approach empowers FreeMove Alliance members and partners to successfully respond to multinational customers’ needs, as well as enabling representatives of FreeMove Alliance and its members and partners to talk about the alliance with one common voice.

- FreeMove Alliance’s customer-facing activities greatly support those of its members, which approach and contract directly using their own product portfolios, with FreeMove Alliance providing the connectivity, global customer management, implementation services, contracting framework, and reporting tools. However, it is building up a Sales 4.0 strategy for managed services, increasing brand awareness and presence of FreeMove Alliance among members and partners, and building up the FreeMove Alliance footprint and messaging for its role in 5G.

- The four members continue their strong collaboration with Bridge Alliance to extend coverage to 34 markets in Asia-Pacific and Africa; other partnerships boost total coverage to 125 countries.

- FreeMove Alliance may be keen to expand its customer base, but it still needs to improve its market visibility. However, new branding, including a new logo, and ongoing awareness campaigns including updated social media and web content helps address these issues.

Service & Support

Rating : Very Strong

- With FreeMove Alliance managing the connectivity relationships between members, its service and support depend on automation and lead members’ physical delivery capability. To manage its newer target customers in mid-size and multi-local MNCs, a FreeMove Alliance central sales support desk supports members’ local account managers and business development managers.

- Members have dedicated more than 500 staff between them to manage and service FreeMove Alliance customers.

- The expanded set of target customers to include smaller mid-market companies requires more support; the new ‘service desk’ approach helps FreeMove Alliance centrally manage local and international requirements for services such as migration and security. The FAS ITSM automation solution can ease ordering and management across members’ networks. A unified approach among members to support mobile private networks could also become increasingly important.

Threats and Barriers

- Internal Competition: Members can choose to use their own expense management system rather than that of FreeMove Alliance, which may result in the latter being less relevant.

- Retention Risks: Despite a high renewal rate, retaining large customers in a competitive market requires continuous value delivery and innovation. Any decline in service quality or failure to meet evolving customer needs could lead to churn.

- Strong Competitors: Competitors like Vodafone Business International (formerly Vodafone Global Enterprise) provide integrated account management with a single per-user, per-month price and single-source accountability. Vodafone Red tariffs offer some of the same flexibility and promise worry-free roaming in 130 countries. Vodafone Business International also offers a DaaS service for customers in its natco and partner markets.

Sustainability

- Environmental: FreeMove Alliance published an ebook describing members’ sustainability initiatives, focusing on renewable energy and carbon emissions, device recycling, sustainable supply chain, and 5G innovation. FreeMove Alliance is committed to promote EcoVadis certification among its members and partners belonging to its footprint. Currently, the four members, plus partners BT, SwissCom, and Odido, have already obtained gold-level certification.

- Social: FreeMove Alliance partners each have their own social responsibility commitments; for example, Orange Business is dedicated to working for digital equity through training open to professionals and students, and to diversity and gender equity at all levels of the company as powerful levers for economic performance and employee well-being. A priority is to increase the number of women in technical and digital professions where women are currently under-represented.

- Governance: FreeMove Alliance is a legally incorporated entity with a clearly defined corporate governance structure. It is composed of a management board, general manager, and functional and support working groups. FreeMove Alliance’s long-term strategy is to continue developing its services and capabilities to provide real benefit to its customers.

Recommended Actions

Vendor

- Provide Evidence: FreeMove Alliance needs to show that it provides value for customers (as well as its members/partners) by highlighting its single point of accountability, its service wrapper, and its contractual commitment to service levels. It should work to get Deutsche Telekom, Orange, Telia, TIM, and partners to highlight their commitment.

- Add New Services: FreeMove Alliance needs to respond to technology advances as its target market looks beyond connectivity to 5G-enabled managed mobility and unified communications. Some of the suggestions by its customer advisory board include more automation to simplify expense management, a device lifecycle management service, a Microsoft Teams Phone mobile solution, and a unified approach to private mobile networks. It is already in progress with some of these offerings, with more to come later in 2024.

- Grow: While its members and partners are in over 100 countries, FreeMove Alliance should continue to seek new partners and grow the alliance in both new markets and geographies (e.g., MEA, APAC, and Latin America). With the exit of Vodafone from key European markets (e.g., Italy, Spain), there may be new opportunities to work with MNCs with a large regional or headquarter presence in those countries.

Competitors

- Vodafone Business International should continue to build out its converged fixed-wireless infrastructure and applications-driven, customized network offers. It should also take care to protect its MNC installed base in countries where it is exiting local network operations.

- VoIP and OTT players can point out that WiFi internet access is free or inexpensive in most countries, and many mobile virtual network operators offer flat-rate roaming in a number of countries.

- Challengers can point out that FreeMove Alliance is essentially an alliance of incumbent operators looking to protect market share; in other MNC situations, Orange and Deutsche Telekom compete for MNC business.

Buyers

- Do Homework: Buyers need to examine FreeMove Alliance’s coverage, key performance indicators, and service-level agreements to ensure that they are relevant to them and that there is a fast and reliable problem-resolution process.

- Contextualize the Big Picture: Buyers need to consider their mobile coverage in terms of their broader mobility strategy, taking into account services such as mobile private networks as well as unified communications and collaboration.

- Neutral Integrators: MNCs that require a multi-network solution could also look to neutral integrators such as NTT, Kyndryl, and DXC Technology, particularly where connectivity service requirements are dictated by application performance issues.

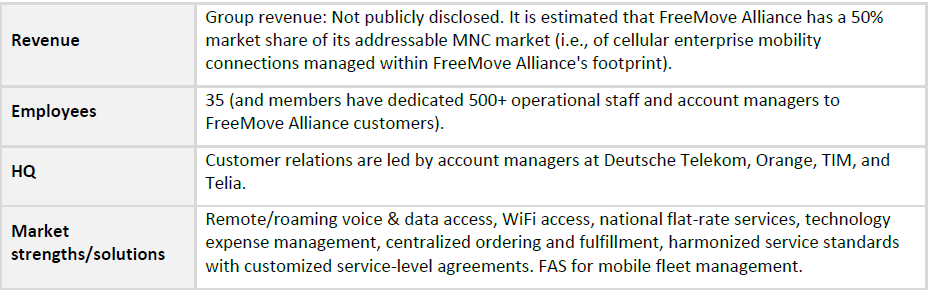

Company Details

Company Snapshot

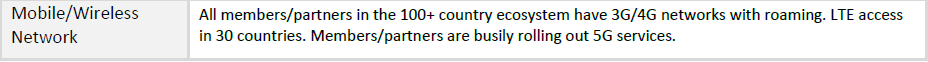

Network Description

Key Recent Announcements and Disclosed Strategic Plans